Podcast: Play in new window | Download

Subscribe: RSS

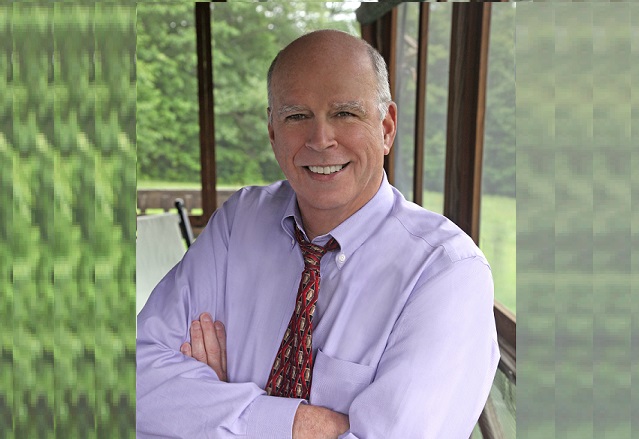

Josh Patrick is a founding principle of Stage 2 Planning Partners and creator of Ask Josh Patrick. Through these businesses, he helps private business owners and their advisors create extraordinary value in their professional and personal lives. Josh is also a speaker, host of thee Sustainable Business Podcast, podcaster, and has written for the New York Times, Inc. Magazine, Forbes, and more.

Takeaway Quote:

“Let’s take the complicated stuff and simplify it. Let’s not take the simple stuff and complicate it.”

Show Timeline:

01:20 How Josh got to where he is today in financial services

Multiple industries and careers, and his two current businesses

05:44 Why Josh hates financial plans

His approach to financial planning and making it a collaborative experience

8:51 How Josh did this work before having access to current technology

His invention of the four boxes of financial independence

11:43 Why the planning process needs to be simplified

Josh’s own experience with exit planning and the lesson learned

13:11 Why he refers to himself as a niche-a-holic

Being real about your expertise and what it means for the future of your business

16:27 Saying ‘no’ with confidence

Why saying no to the wrong people helps you better serve the right people

19:24 How Josh positions himself to the world

The extensive amount of content he’s created to demonstrate his expertise

21:09 Personal niche vs. firm niche

The question Josh is still considering, and related examples from his firm and others

24:41 The danger of diluting the messaging of a firm with multiple brands

What this can mean for business succession, and the typical succession strategy

29:30 The five things to do to create a sustainable business

What makes a business one that someone else would want to own

33:11 How this leads to becoming more referable

Exhibiting your expertise by becoming a thought leader

Links:

Websites: www.askjoshpatrick.com, www.stage2planning.com

Email: jpatrick@askjoshpatrick.com

“Success to Sustainability” Audio CD: Text “sustainable” to 44222 or click here

Podcast: http://askjoshpatrick.com/category/sustainable-business-podcast/

Twitter: https://twitter.com/AskJoshPatrick

LinkedIn: https://www.linkedin.com/in/askjoshpatrick/

Want more?

Stephen Wershing: www.TheClientDrivenPractice.com/checklistblog

Julie Littlechild: www.absoluteengagement.com/blog

Episode Transcript:

Steve Wershing: We have a great conversation about what it means to run a successful financial advisory business. We talk about things like plans versus planning. We talk about how to understand where the real value lies in your business. We talk about the fact that Josh is a niche-aholic, and why it’s important to know who you’re meant to serve. We talk about branding individual advisors versus branding your advisory firm. Why it’s important to become irrelevant in your firm, and the five things you need to do to have a sustainable business. It’s a great conversation with a lot of tips on how to run a more successful advisory business. So, without further ado, here’s Josh Patrick. So, Josh, welcome to the show. We’re tremendously pleased to have you here. Josh Patrick: Steve Wershing: Josh Patrick: Julie Littlechild: Steve Wershing: Josh Patrick: Steve Wershing: Josh Patrick:

Welcome to Becoming Referable, the podcast that shows you how to become the kind of advisor people can’t stop talking about. I’m Steve Wershing, and on this episode, we talk with Josh Patrick, founding principle of Stage 2 Planning Partners, and the man behind AskJoshPatrick.com. Josh has something of a distinction among financial planning practitioners, in that he’s run other businesses in different industries before he came to financial advice.

Thanks, it’s a thrill to be with you folks today.

Josh, part of what’s interesting about you is your background, and that financial services was not your first career and, in fact, even now, you’ve got a career that’s sort of separate from that. Can you sort of tell us how you got here?

Sure. I was going to college, thought I was going to be a lawyer, and my senior year I actually started looking at what lawyers really do in life, and said, you know, I don’t think I’d be really happy having to defend guilty people. I felt that was probably a bad choice for me, and I was going to Boston University at that time, had a bunch of job offers at BU, and I also had a chance to join the family business. And, like many people joining family businesses, it was the path of least resistance. And that’s what I ended up doing. So, my first 20 years in business, I joined the family business, bought part of it from my father, built that up, ended up buying his piece of the business back about 15 years later, and after 20 years I figured out that the vending business was one of the two or three worst industries in the United States.

Congratulations on choosing that.

Yes, right, nice. Nice work.

Yes, that was a great choice, and I decided it was probably time to sell, and luckily, I found a buyer for us. And after I sold, I said, okay, there’s one of three things I can do. I could go into life insurance business because I like consultative selling, and my experience with our life insurance agents was they did a really good job of that. I could have opened a software company, because I was really kind of a tech savvy guy, and I liked it, but I didn’t know how to program and didn’t want to learn. Or, I could have done public speaking because I had been doing a lot of that at that point at the end of my vending career, but again, I didn’t want to be on the road 100 days a year. So, I said, well, life insurance sounds good, I like it, let’s give it a shot. I started working for a large life insurance company, and lo and behold, I found out that when you work for a life insurance company, they want you to sell life insurance.

How about that? Who would’ve thought it?

Yeah, but my natural market was private business owners, and when you’re working with private business owners, life insurance is important, but it doesn’t solve even 3% of the issues they have. So, I left the life insurance company, opened my own wealth management firm, joined Partners Financial, which was an insurance producer group, they had just started a broker dealer which became NFP Securities, is now Kestra, did that for 20 years, and then last fall, we decided it was time for us to leave the commissioned world, move into the fee-only world, and we formed our own RIA. And while I’ve been doing this, I also have started a sister company called Ask Josh Patrick, where I do coaching, mentoring, for private business owners on how to create a sustainable business. I sort of have two tracks that I run on, and I spend a lot of time in the sustainable business world of how you create an economically and personally sustainable business. And we can get into the five things you need to do if you want to. But, that’s how I got to where I am.Read more

Leave A Comment